FanDuel, DraftKings Scale Back on Marketing Ahead of New Football Season... With Some Exceptions

Tired of all those FanDuel and DraftKings commercials promising free money to those who join? You'll be seeing fewer of them this NFL season.

Nearly all of the sports betting operators plan to cut back promotions in some states, most Notably New York, as profitability targets loom.

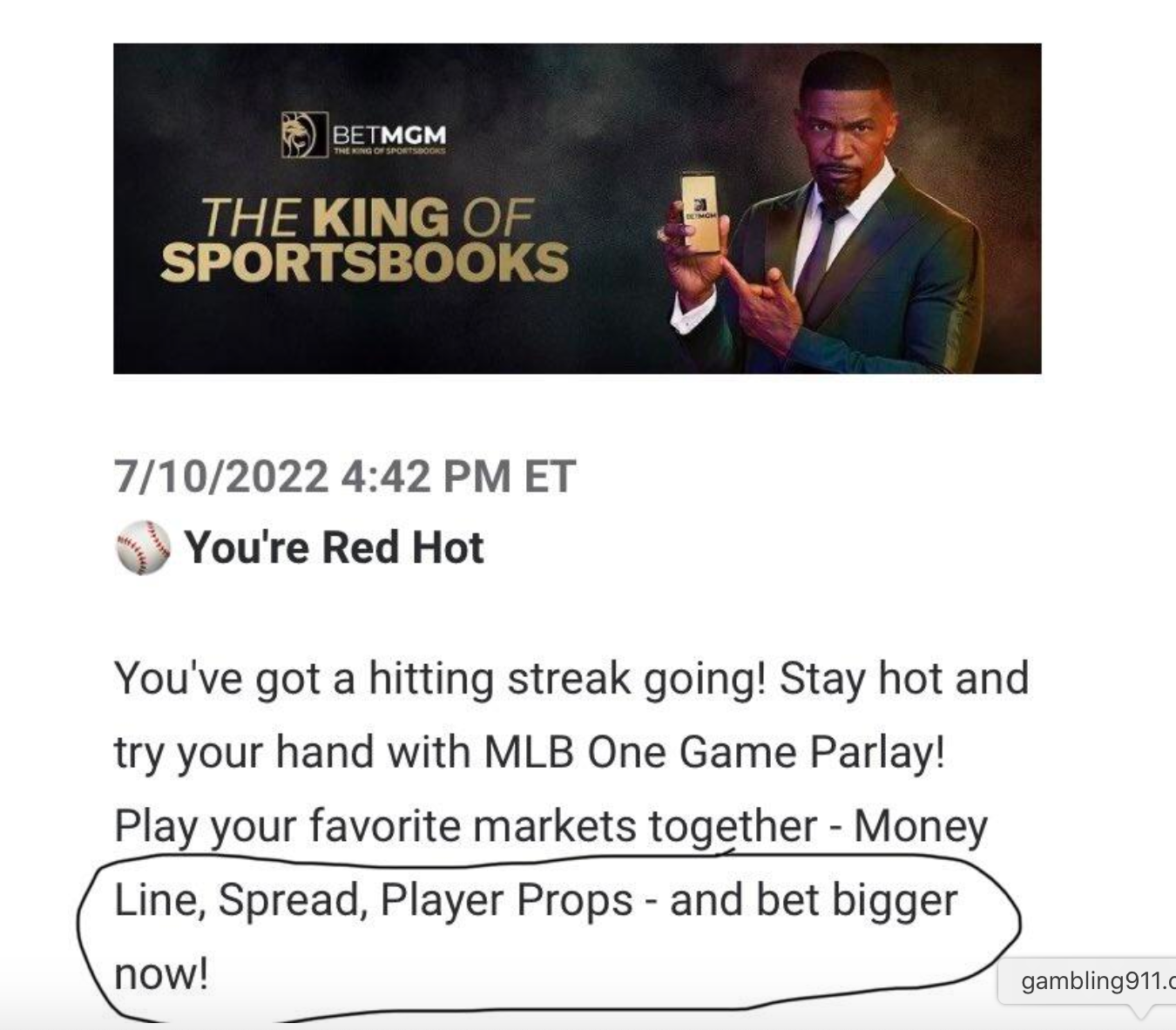

BetMGM has already notified its New York-focused affiliates that it will be suspending all bonuses in the Empire State.

New York has accounted for more than half of this year’s total tax revenue since launching in January of this year. The handle is close to 20%. That makes it nearly impossible for these betting firms to operate there when giving away the shop with freebies.

“I think what we’re seeing is, everyone is looking around going ‘Hang on, it’s gone too far,’” BetMGM Chief Executive Adam Greenblatt told the New York Post. “We need to make money. The market, frankly, is expecting us and others to make money.”

Greenblatt said the company is using data to identify which customers will be the most valuable for offering bonuses.

“We’ve become a lot smarter, a lot more fussy and deliberate, about who gets what,” he said.

One state's loss is another state's gain.

Enter Kansas.

Some affiliates were already offering a Free $200 pre-registration signup bonus for Kansas residence, even though sports betting has yet to officially go live there.

With a population just shy of 3 million, Kansas is the big "get" entering this new football season. Better than 800,000 of that number resides within the Kansas City, Missouri area. That "other" Kansas City, located in Kansas, is actually the state's third most populated city with 153,014 people while another KC suburb, Overland Park, is the second largest with a population of 193,412. The state's fifth largest city of Topeka overlaps into this region as well. This is Chiefs territory, and the fanbase extends well into Kansas.

“For the most part, this category is still very new and there’s a ton for us to do to be able to ignite (returning bettors) and welcome people into the category who have had the opportunity to come in but just haven’t yet,” FanDuel EVP/Marketing Andrew Sneyd told the Sports Business Journal in regard to the emerging markets. “That’s a lot of what we’re building with the Wieden campaign.”

That reference to Wieden was to the first ad campaign of the new season launched by that agency for FanDuel. The first of seven ad spots launched Friday, August 19 as this was going to press.

"As we built the campaign, we wanted to make sure that we’re really referencing the fact that FanDuel is No. 1, and by quite a bit,” Sneyd said. “Part of how we built this campaign is that there may be a lot of odds that you need to take with little bets in life -- but the one bet you don’t need to take is betting without America’s No. 1 sportsbook.”

Over the past two years, DraftKings and FanDuel spent hundreds of millions of dollars on marketing campaigns.

All but one of the sports gambling companies has failed to post a profit since coming online in 2018 when the U.S. Supreme Court abolished decades long prohibition. FanDuel reported its first quarterly profit ever last week.

DraftKings net loss for Q2 was US$217 million, compared to US$306 million for the year prior. The betting firm's net loss for the first six months of 2022 was US$685 million.

Its “sales and marketing” jumped to $197 million in the second quarter compared to the $170 million in Q2 of last year and $321 million in Q1 of 2022.

Caesar’s Entertainment said last week that it reduced approximately $500 million in “unneeded” ad spending.

Another state focus will be on one that doesn't even offer sports wagering yet, and won't until at least next year if all goes according to plan.

DraftKings and FanDuel will be spending money on efforts to push their November election referendum in the state of California. Their measure would legalize mobile sports betting statewide under the guise of eliminating homelessness.

They won't have free rein however. Another group, composed mostly of state tribes, will compete with a referendum of their own pushing for retail-only gambling on sports.

- Chris Costigan, Gambling911.com