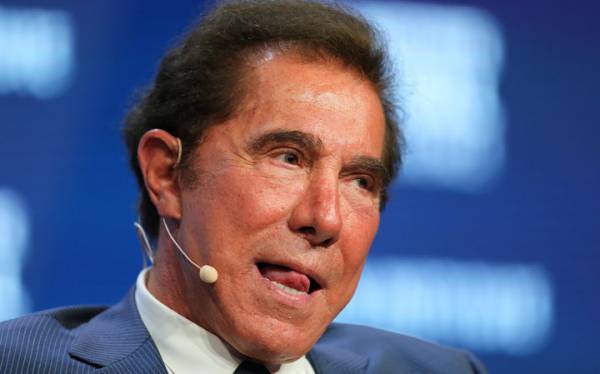

State Sues Wynn and Board of Directors for Failing to Stop Sexual Misconduct

SALEM, Ore. — (Associated Press) - The state of Oregon has sued Nevada gambling mogul Steve Wynn and the board of directors of Wynn Resorts Ltd. for allegedly failing to act in the best interests of shareholders and stop sexual misconduct at the company, state officials said Wednesday.

The civil case, alleging massive breaches of fiduciary duty that caused damage to the company and impaired long-term shareholder value, was filed Tuesday in district court in Clark County, Nevada. Last month, New York's public pension fund, the nation's third largest, filed a similar lawsuit.

The offices of Oregon Attorney General Ellen Rosenblum and Read announced the lawsuit, saying Oregon's pension system held 8,506 shares of Wynn Resorts worth $1.3 million, and that the investment is suffering a loss because of misconduct and inaction.

Scroll Down For More..

The lawsuit is part of another front opening up in the #MeToo movement that aims to make those involved in sexual misconduct, and those who cover it up, accountable. The movement launched after an October expose of movie mogul Harvey Weinstein by The New York Times.

"This filing will help hold the Board of Directors and Mr. Wynn accountable for their profound dereliction of fiduciary duty," said Oregon Treasurer Tobias Read.

Wynn Resorts spokesman Michael Weaver said he had no comment on the lawsuit. Wynn has denied he harassed and assaulted women. He resigned as chairman and CEO of the company bearing his name Feb. 6.

Related: Vegas casino king Steve Wynn accused of ‘pattern of sexual misconduct’ in Wall Street Journal report

"The story of Steve Wynn is a cliche: a powerful man preying on the powerless," the lawsuit said. "But the Directors of Wynn Resorts were not powerless. They were the only people with the knowledge and ability — and duty to the company — to investigate and stop Steve Wynn's conduct."

Instead, the board of directors "devoted substantial company resources" to covering up the alleged misconduct, the lawsuit claimed.

Since the Wall Street Journal broke the story in January on Wynn's alleged misconduct that goes back years, Wynn Resorts has lost $2 billion in market capitalization, the Oregon lawsuit says.

Oregon's action is the latest known "derivative lawsuit" filed in state court in Las Vegas against the board and the billionaire.

Related: Steve Wynn, casino mogul, resigns as RNCfinance chair amid misconduct allegations

Besides New York and Oregon, at least four other shareholder groups have filed lawsuits. Derivative lawsuits allow shareholders to take legal action on behalf of a company when they believe its officers or directors are not meeting their fiduciary duties. If the complaints are successful, Wynn and the company's board members could be ordered to pay monetary damages to Wynn Resorts, not the shareholders who filed the lawsuits.

San Diego-based attorney Todd Neal with the firm Procopio said the lawsuits seek monetary damages for the alleged loss in share price because of breaches of fiduciary duty, compliance with company policies and the possible removal of company board members.

The Massachusetts-based Norfolk County Retirement System and Pennsylvania-based Operating Engineers Construction Industry and Miscellaneous Pension Fund are among the other shareholder groups that have sued the Wynn Resorts' board.

Associated Press writer Regina Garcia Cano in Las Vegas contributed to this report.