Investors Unnerved by Playtech Planned Acquisitions: Shares Fall

(Reuters) - Playtech, the world's biggest provider of online gaming software, plans a string of acquisitions as it branches out into the social gaming market but news that it will be buying the businesses from its main shareholder unnerved investors.

The Estonia-based firm said on Tuesday that it planned to spend 95 million euros ($124.1 million) buying assets owned by Israeli billionaire Teddy Sagi who founded Playtech and still owns a 48 percent stake in the company.

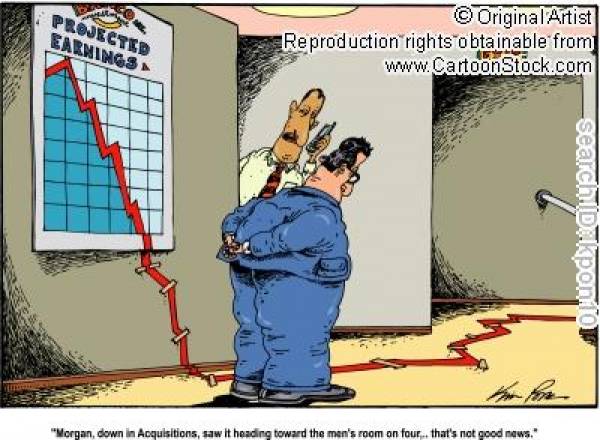

Shares in Playtech, which is one of the biggest companies listed on London's junior AIM market, were down 4.4 percent at 335.25 pence by 1001 GMT having earlier fallen as much as 9.7 percent to 316.66 pence.

"Where concerns will be raised is that once again Playtech is acquiring assets from its founder and largest shareholder," Simon McGrotty, analyst at Davy Research, wrote in a note to clients.

"Ninety five million euros is a significant investment, especially in an area that is relatively unproven - there is no mention of the current profitability of the assets being acquired in this morning's announcement," McGrotty added.

Playtech said it had signed a memorandum of understanding to buy assets including social gaming products where people playing interactive games online can buy virtual currency, such as Facebook credits, to use as part of the game.

It also plans to buy what it called "play for real" products such as casino and mobile poker software for selling to online gaming firms and a 20 percent stake in a social gaming operation targeted directly at consumers.

Playtech said in a statement that the consumer-facing part of the deal would create an additional earnings stream in one of the fastest growing segments of the gaming industry.

Sagi, whose wealth is estimated by Forbes to be around $1.2 billion, has also provisionally agreed to become a company advisor ahead of Playtech's proposed move away from an AIM-listing to a prime market listing where it hopes to gain a place on the midcap FTSE 250 index.

Given the potential conflicts involved in buying assets from a major shareholder, Playtech said other shareholders would get to vote on the proposed deal.

"The market will be disappointed by the related party nature of the transactions," said Panmure Gordon analysts Simon French and Lindsey Kerrigan, who maintained a "hold" recommendation on Playtech stock.

Playtech also said it planned to buy or rent a new office worth 10.5 million pounds from a company in which Sagi has a beneficial interest and announced plans to accelerate payments for PT Turnkey Services (PTTS), a company which was also partially owned by Sagi before Playtech acquired it.

Playtech will get a 4.2 million euro discount on the PTTS deal price in return for the early payment. It described the unit's performance since acquisition as very strong and said the first quarter of 2012 had been outstanding.

The company, which operates a joint venture with Britain's biggest bookmaker William Hill, said in January the opening up of online gambling markets and relaxation of gambling laws across the world would present opportunities for global expansion.