Billionaire Investor Bows Out of Casino Gambling Business

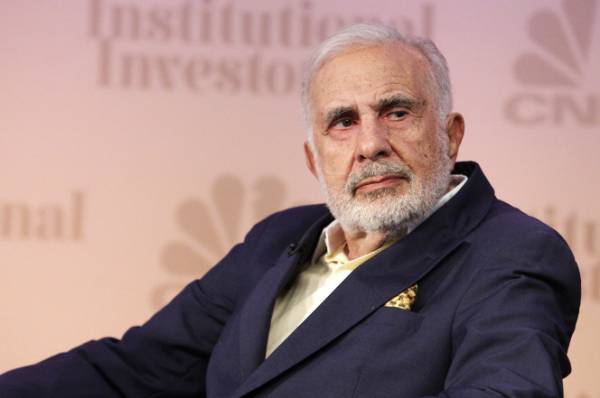

As detailed in an April 16 report by on PlaySlots4RealMoney.com, it looks billionaire investor and business mogul Carl Icahn has had enough of the casino business after more than two decades on ownership interests. The news broke on Monday when Icahn Enterprises publicly announced that it is making an exit from the casino industry with the sale of all its related real money gambling operations.

More specifically, it announced that it is selling Tropicana Entertainment and six of its eight casino properties to real estate investment trust Gaming and Leisure Properties (GLP) for a price tag of $1.85 billion. Under the terms of this deal as noted in the PlaySlots4RealMoney.com report, GLP will pay Icahn $1.21 billion and Eldorado Resorts out of Reno will assume the leases of the resorts and pay the remaining $640 million. Carl Icahn relayed the fact that he was proud of the role his company played in saving Tropicana Entertainment since it acquired a majority stake in the company in 2008. In a direct quote in this report, he stated, “Tropicana was bankrupt and desperately needed new leadership. By hiring a great CEO…and a great management team, and by reinvesting every single penny of profits back into the company, we turned Tropicana into a great casino company.”

Tropicana Entertainment has casino gambling operations in Indiana, Louisiana, Mississippi, Nevada, Missouri, New Jersey and Aruba. Six of those properties were part of this deal. Icahn noted that the shuttered Trump Plaza in Atlantic City, NJ and the company’s casino resort in Aruba would be sold at a later point in time. Tropicana Las Vegas on the famed Strip in the casino gambling capital of the world is owned and operated by Penn National Gaming. It was also not part of the deal with GLP. Carl Icahn built his reputation as a business mogul and his fortune as a billionaire by buying up struggling companies at a deep, discounted price only to sell them down the road for a much larger sum of money. Some would say that he defines the term ‘corporate raider’. This strategy has not always worked in his favor in the casino industry after his company lost hundreds of millions of dollars by his own account on the former Trump Taj Mahal.

A recent casino deal that netted close to half a billion dollars for investors was the sale of a Las Vegas property on the Strip to New York real estate company Witkoff for $600 million last August.

The report goes on to detail how Icahn bought the Fontainebleau in Las Vegas back in 2010 in bankruptcy court for $150 million. This massive casino and resort project was only 70 percent complete at the time and it sat idle for close to 10 years.In 2008, his company netted close to $1 billion dollars wi th the sale of its stake in American Casino & Entertainment as the parent company of Stratosphere and Arizona Charlie’s. These properties were originally acquired in 1998 for $300 million and sold to a mutual fund a decade later for $1.3 billion.