Crypto Trading is Changing, Thanks to AI Bots

If there is one topic that has dominated headlines this year, it has been artificial intelligence (AI). With all the focus on tools like ChatGPT and all the things it can do, from writing wedding vows to taking law school exams, the public’s interest is at a fever pitch. It has also become apparent that AI can influence virtually every sector of public life from art to music to business.

But one thing that every crypto lover should keep in mind is that AI can and will have an effect on digital asset trading. While the two are not immediately mentioned in the same sentence, AI is well on its way to changing how we trade these assets.

The first way that AI is changing crypto trading is by streamlining the research process. AI is already being used to write everything from song lyrics to college essays, so it comes as no surprise that AI tools are being used for crypto research. This could be seeking out the history of a specific token to determine whether or not it is legitimate to straight-up asking the AI which tokens would be good to invest in. Users currently turn to these guides and others to do their research, but this could change.

The crypto market is flooded with so many assets that for the average trader, separating the wheat from the chaff could take more time and effort than making actual trades. Everyone seems to be looking for the tokens that are on the cusp of exploding in value and buying in before then. But with a bit of AI help, this research time and effort could be reduced significantly.

Then there is when to invest at all. We’ve all seen endless articles predicting when Bitcoin will go to the moon or when is the best time to buy or sell or HODL. AI could, to an extent, advise traders on when it is best to make a move or not make a move. Just like with spotting prime tokens to invest in, most crypto traders are used to studying market movements and trying to spot patterns. How much does Bitcoin move after a halving? What effect will an SEC announcement make on the industry?

But effectively doing this means either being naturally talented at spotting patterns and micro-trends in the market or studying months or even years of charts. These take a lot of time and so, it’s no surprise that some are turning to AI to make the process easier. Why spend hours comparing graphs when you can type a simple prompt into ChatGPT and get your answer in an instant?

Strikingly, some experts suggest that crypto traders could essentially outsource the process of trading to AI via trading bots. AI trading bots, in this sense, refer to AI software that can be programmed to complete tasks for its user. Think of the way we can tell our home assistants to wake us up at a certain time in a certain way.

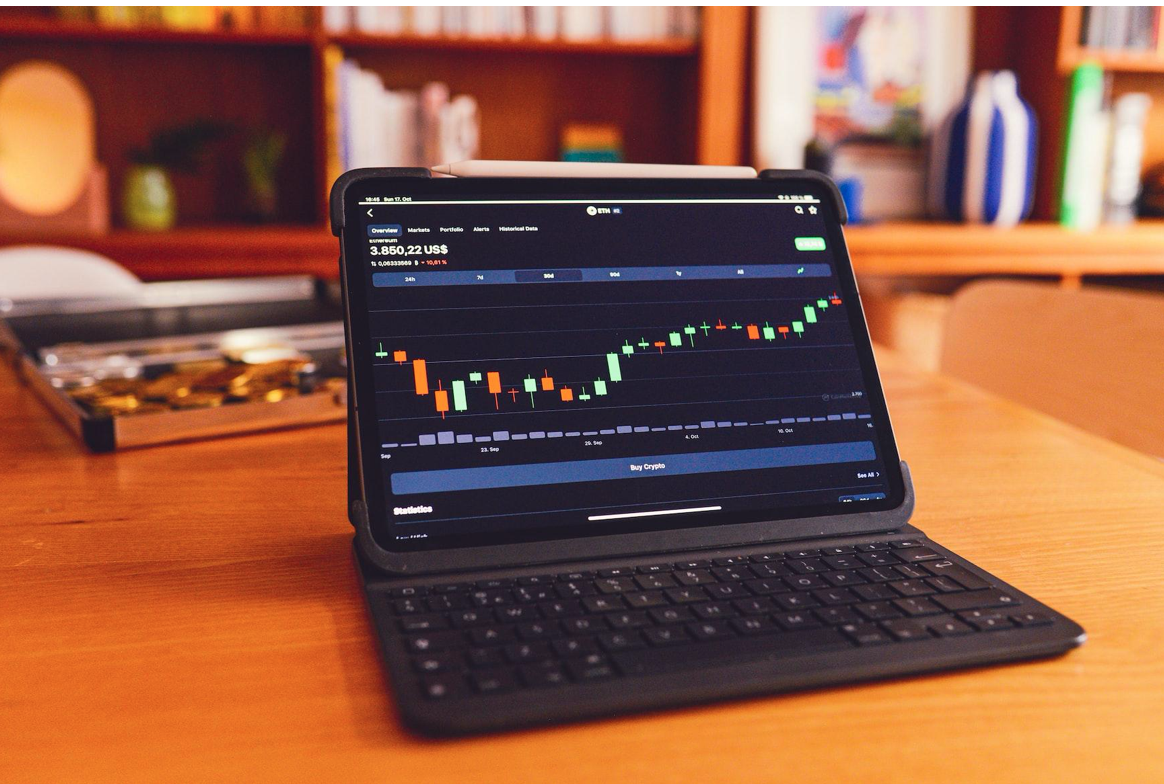

But instead, these bots can be programmed to analyse the market and make trades on your behalf. Take, for example, a trader who deals mainly in Ethereum. These bots will be responsible for scouring the internet for information about the ecosystem and developments that could affect its price, as well as checking its price throughout the day. Then, under optimum market conditions, the bot will buy and sell the crypto to maximise profits for its user. The user in question does not need to do anything other than program the AI, provide access to their fiat and/or crypto wallets and go about their day.

Simply put, these bots trade on behalf of the users as opposed to helping with research or giving trading predictions and advice. It is worth noting that automated trading is not a new concept; trading platforms like eToro are famous for their copy trading function that lets users automatically copy the trading moves of others. So clearly, there is a demand for this convenience.

But AI trading bots take this to a whole new level by requiring the customer to do as little as possible. This will likely appeal to the class of crypto traders who only trade part-time and don’t want to spend hours in front of a computer screen to trade. If this trading tactic picks up steam, we could see a crypto market in the next few years with a higher percentage of trades run by automated AI tools.

Of course, there are still certain things to consider. The first is that any asset market can be automated, but it will still be affected by the actions of humans which cannot always be predicted by AI. As experts have explained, AI functions by collecting and analysing existing data. They are, however, not crystal balls that can 100% predict the future. Think of the sudden spike in Dogecoin and other memecoins that have taken off due to a few viral tweets or world events.

Just last year, there was a flood of NFTs and cryptos relating to the death of Queen Elizabeth II. No AI could have predicted her death date or the specific tokens that would spike as a result. Then, of course, we have to consider the fact that AIs are machines and machines can and have been exploited by malicious parties in the past.

We only need to look at the Decentralized Finance (DeFi) sector as an example. Many platforms had smart contract protocols that controlled the movement of funds, whether for loans, trading, lotteries, and so on. Some of these protocols like Euler and Arcadia have been exploited in the past, showing that no system is foolproof. As AI trading bots become more of a part of the industry, it is imperative that the possible security risks be acknowledged and provisions made to counter them.

All in all, it is clear that AI trading bots are here to stay. The extent to which crypto traders will use them in comparison to more ‘manual’ trading, the implications for the wider market, and how the industry will rise to its potential challenges, however, are still unravelling.

- Aaron Goldstein, Gambling911.com