NJ Online Gambling Revenue February 2023

Casinos in New Jersey rounded off the month of February with a total revenue of $412.2 million from both iGaming and sports betting activities in the state.

According to a press release from the New Jersey Division of Gaming Enforcement, the revenue from online casinos fell 6.7% from the record-setting figures of January 2023. NJ casinos had pooled a total of $152.9 million in iGaming revenue at the start of year but could only manage to rake in $142.6 million throughout February. Online casino operator winnings from slot games and live dealer titles also tailed off 6.6% from January to $140.3 million.

However, compared to the total iGaming revenue recorded back in February 2022, a year-over-year comparison indicates an encouraging 9.7% increase. Unfortunately, poker revenue could not keep up the pace falling by 15.7% to $2.3 million after February’s 29 days.

“Internet gaming pushed February 2023 to new heights setting new near-term records for single month February and year-to-date February revenues,” said Jane Bokunewicz, faculty director at Stockton University. “Internet gaming remains a significant portion of the Atlantic City gaming industry revenue mix accounting for nearly 40% of total gross gaming revenue share for the year-to-date.”

On the other hand, retail casinos picked up some momentum with a 1.6% revenue boost from January to approximately $215 million. Year-over-year comparisons also reveal a 1.2% increase from February 2022’s figures.

Revenue from Games and Sports Betting in New Jersey

Despite the general revenue decline, slot games were significant gainers at New Jersey casinos. Slots improved by 4.9% on a month-over-month analysis, bringing in $159.3 million. Revenue from table games, however, fell by $4.2 million between January and February, bringing their total contribution to NJ casino financials down to $55.6 million. On a comparable year-over-year period, slot games revealed a 1.2% revenue boost while table games could only manage a 4.9% decline. This should not come as surprise since New Jersey casinos boasts a diverse selection of online slot games including classic 3-reel games, modern 5-reel titles, progressives, jackpot options, and much more

Sports betting was similarly discouraging in the state, recording the highest percentage decline of all gambling activities in the state. Sportsbooks in the Garden State saw a 24.5% decrease in sports wagering revenue from January 2023. It pooled $54.6 million in betting revenue and $847.4 million in handle, all while maintaining a hold of 6.5%.

New Jersey operators recorded $42.9 million as its total industry tax receipts. $21.4 million of that figure came from iGaming while retail casinos contributed $14.3 million.

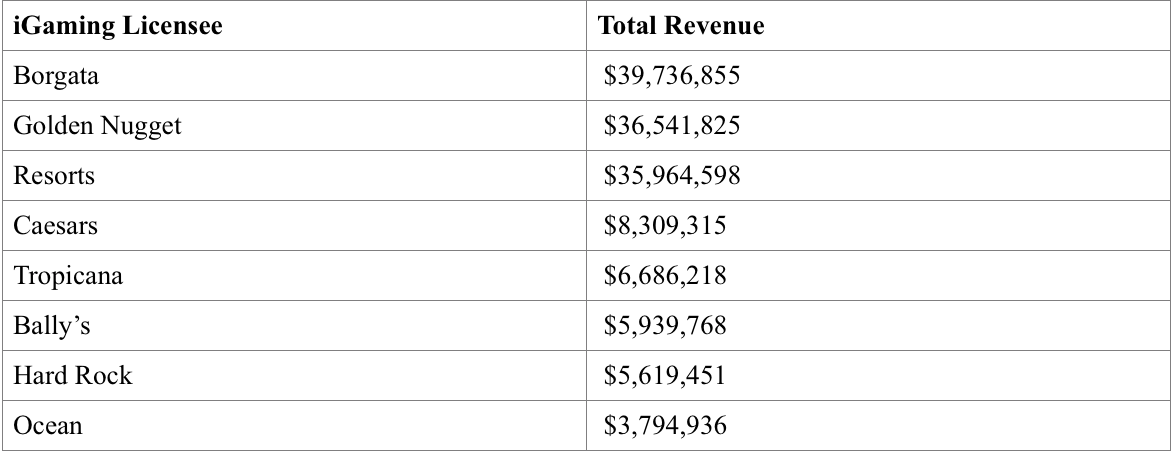

Borgata Remains Highest Grossing Casinos Despite General Decline

The eight online casino operators in New Jersey had varying revenue postures at the end of February, with many losing out on significant gains made in January 2023. Resorts casino fell from its two-month run of consecutive $40 million revenue figures to barely recording $36 million in February. Similarly, Golden Nugget could not sustain its January record-setting revenue of $40 million, experiencing a 10% decline to $36.5 million. Tropicana Casino was the worst hit, with a 14.8% fall to pool in $6.7 million.

However, Caesars casino and Bally’s were two casinos that recorded month-over-month revenue increases. Bally’s ended February with a 15.5% boost to bring its iGaming revenue to $5.9 million while Caesars saw a 0.4% growth to sign off the month with $8.3 million in revenue.

Borgata remains the leader of New Jersey’s casino gambling industry topping all other operators for retail casino and iGaming win revenue. Here’s a list of the top grossing casinos in New Jersey in February 2023.

- Payton O'Brien, Gambling911.com Senior Editor