Antigua Freezes Assets in Stanford International Bank

Much as they did when one of the world's largest online gambling firms, BetonSports, shut down under investigation nearly three years ago, the tiny Caribbean nation of Antigua has froze all assets in its largest bank (and the biggest employer of Antiguans), Stanford International Bank.

Antigua, one of the leading centers for online gambling, find itself center stage of the latest "investment fraud" scandal.

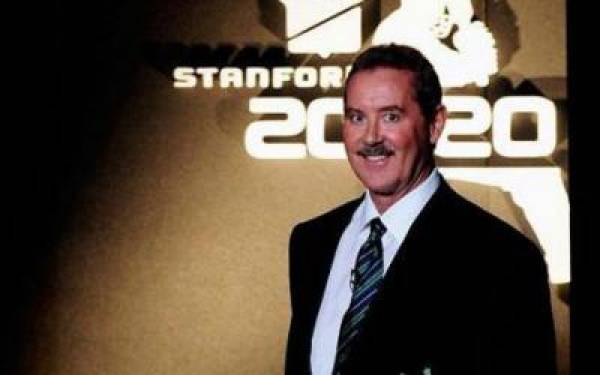

Banking regulators and politicians are scrambling to contain the damage after the U.S. Securities and Exchange Commission (SEC) filed civil fraud charges against the billionaire bank owner, Allan Stanford, on Tuesday.

Public records also show Stanford owes hundreds of millions of dollars in federal taxes.

In a bizarre twist, news surfaced on Wednesday that Stanford had been a major political player in the U.S. as well, where some congressmen announced they would donate his campaign contributions to charity.

Most of the cash flowed during the 2002 election, when Congress was debating a financial-services antifraud bill that would have linked the databases of state and federal banking, securities and insurance regulators.

Among the biggest recipients have been Sen. Bill Nelson, D-Fla. ($45,900); Sen. John McCain, R-Ariz. ($28,150); Sen. Chris Dodd, D-Conn. ($27,500); and Sen. John Cornyn, R-Texas ($19,700). Rep. Pete Sessions, R-Texas, also received $41,375.

Jay Cohen, founder of World Sports Exchange, one of Antigua's largest online sports betting companies, commented on the Major Wager.com website that none of the major online gambling groups would have kept money in Stanford International Bank, despite the i-Gaming sector being Antigua's largest after tourism.

"Stanford would not take any business from gambling companies or individuals who made their money from gambling. Either because he was a Southern Baptist, or he didn't want any activity that would put his operations on the radar, or both."

Antsy investors and bank customers were hoping that Antigua's investigation into Stanford International Bank would not be a repeat of the BetonSports fiasco. Following that firm's abrupt shutdown after FBI arrests of BoS officials, Antigua froze the company's assets and appointed a liquidator, Vantis.

Customers of BetonSports are yet to be paid.

A report published by their liquidators in October of 2008 stated the following:

Based on asset realisations to date by ourselves and the Gaming Regulator in Antigua, and known and estimated creditor balances (both gaming creditors and trade creditors) in the Liquidation estate, the dividend availability if a distribution were made at this time would be less than 5 cents on the dollar, or 5%.

We therefore consider it imprudent and economically unviable to circulate a dividend at this time, pending possible further assets being recovered as referred to above.

The statement further advised:

Where sufficient financial records are available we continue at this time to pursue Company funds located in various jurisdictions including the USA, South Africa and Germany. These funds partly represent international payments in transit frozen by payment processors at the time of the declaration by the U.S government that internet gaming was unlawful. We are seeking to secure settlement of funds where appropriate without recourse to expensive litigation in those jurisdictions.

Whether the Stanford International Bank situation turns into a similar scenario as what has transpired with BetonSports to date remains to be seen. But this news surely wouldn't bode well with Pinto Ramos, a 48-year old Venezuelan software-firm owner who flew into Antigua by chartered plane from Caracas on Wednesday with five other investors to check their accounts.

"I don't know what to think. I have my life savings here," Ramos told the Associated Press Wednesday. "We're waiting to see some light."

Jagajeet Chiba, Gambling911.com